How is artificial intelligence reshaping the landscape of the insurance industry? The rapid adoption of AI technologies is fundamentally transforming insurance operations across all sectors. With the global AI insurance market expected to reach USD 30,068.1 million by 2029 at a CAGR of 35.1%, insurers are racing to integrate these technologies into their service models.

Currently, 29% of insurance companies worldwide use AI, with North American firms projected to increase AI use by 30% in underwriting and claims processing compared to 2019. Regulatory guidance from the NAIC’s Model Bulletin has been adopted in 21 states to ensure responsible AI deployment in the industry.

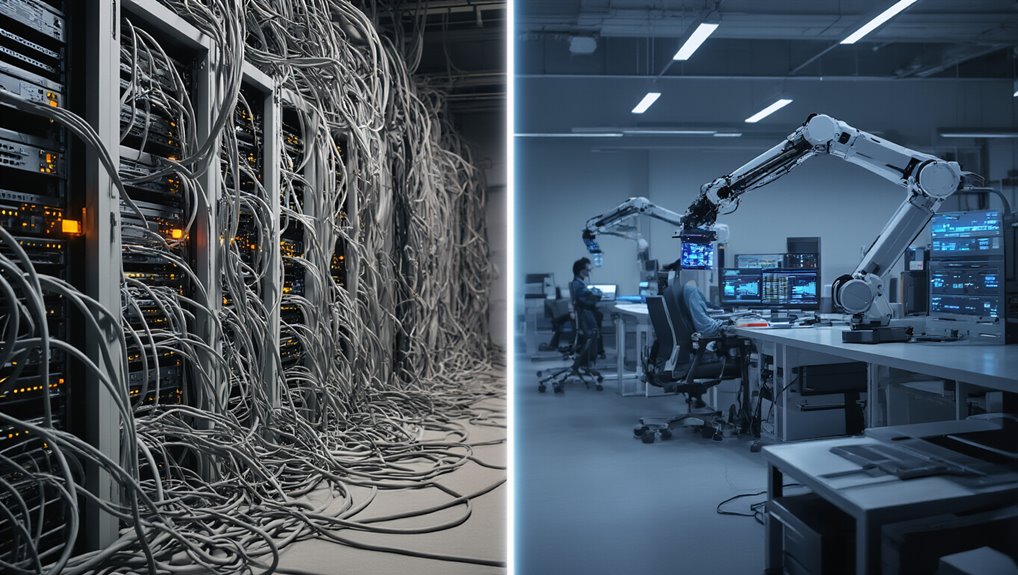

AI adoption in insurance is growing rapidly, with North American insurers leading the digital transformation revolution.

AI’s most significant impact can be observed in claims processing, where implementation reduces processing time by up to 60%. Computer vision technology analyzes damage through images and videos, cutting manual inspection costs by half. Allianz’s ‘Incognito’ system exemplifies this advancement with a 29% increase in fraud detection for motor and home insurance claims.

In underwriting, AI-driven risk assessment is optimizing decision-making processes. About 54% of insurance companies now use AI for pricing decisions, resulting in reduced loss ratios by up to 15%. Life insurers generate synthetic data to enhance risk assessment models, enabling more accurate predictions and personalized insurance plans. The increasing focus on AI explainability techniques ensures transparency and trustworthiness in these complex underwriting models. Many insurers are also establishing an Integration Center of Excellence to govern their AI initiatives and maintain consistent standards across various implementation projects.

Customer experience has transformed through generative AI, creating hyper-personalized interactions based on individual preferences. AI-powered chatbots provide immediate access to information, while predictive modeling forecasts customer churn, resulting in a 20% reduction in customer attrition. These systems boost productivity by nearly 40% through streamlined workflows.

The operational efficiencies gained through AI integration are substantial:

- 60% increase in operational efficiency

- 20-40% reduction in customer onboarding costs

- 10-20% improvement in sales conversion rates

- 10-15% increase in premium growth

As insurance companies continue embracing AI technologies, the industry is approaching a tipping point. Service integration will likely be completely redesigned around AI capabilities, with traditional processes giving way to data-driven, automated systems that deliver faster, more accurate, and highly personalized insurance services.